Yield to Maturity Calculator: Calculate Bond YTM Formula

A Yield to Maturity (YTM) Calculator determines the total return an investor can expect if a bond is held until maturity, considering its market price, par value, coupon payments, and time to maturity. The approximate formula for YTM is: YTM ≈ (C + (F – P) / N) / ((F + P) / 2), where C is the annual coupon payment, F is the face value of the bond, P is the current market price, and N is the number of years to maturity.

Yield to Maturity Calculator

Estimate the total return you can expect to receive if you hold a bond until it matures.

Bond Math Decoded: Quick Answers & Pro Tips

Get accurate results in under 60 seconds:

Face Value: Usually $1,000 (standard bond size) – check your documentation

Coupon Rate: Enter as percentage (5%, not 0.05)

Years: Use decimal for partial years (2.5 for 30 months)

Current Price: Check your broker’s quote screen

Pro Tip: Most corporate bonds pay semi-annually – select that frequency unless you’re sure otherwise.

Your YTM number is like your bond’s MPG rating – here’s what it means:

Higher than coupon rate = Buying at a discount (potentially good)

Lower than coupon rate = Paying a premium (check your strategy)

Industry Benchmarks:

AAA Corporate: Usually 0.5-1.5% above Treasury

High Yield: Expect 3-6% above Treasury

Quick Take: If YTM is significantly higher than similar bonds, there’s usually a catch – check the issuer’s credit rating.

Don’t let these rookie mistakes mess up your numbers:

Price Check: Enter price per $100 face value as $100, not $1,000

Frequency Mix-up: Semi-annual is standard – annual can skew your results by 0.1-0.2%

Zero-Coupon Alert: For zeros, just use face value, price, and years – ignore coupon inputs

Market Reality: If your YTM looks too good to be true (>2% above similar bonds), double-check your inputs.

Three steps to bond-math mastery:

- Enter Basic Info

- Face value (usually $1,000)

- Current market price (from your broker)

- Years until maturity date

- Add Coupon Details

- Annual coupon rate as percentage

- Payment frequency (usually semi-annual)

- Interpret Results

- YTM = Your “all-in” return rate

- Current Yield = Just the income part

Quick Check: Your YTM should be between your current yield and coupon rate if the bond’s trading near par.

Details

- by Rhett C

- Updated August 25, 2025

- Add to your website

Why send your precious traffic to a 🤬 competitor when customers can crunch numbers right on your turf?

Fill out this quick form (takes 37 seconds, we timed it) & your custom calculator zooms into your inbox faster than you can say "conversion rate 💥".

Understanding Yield to Maturity (YTM): Formula, Calculation, and Practical Use

Looking to figure out if that bond investment is actually worth your time? You’ve probably heard about Yield to Maturity (YTM), but let’s cut through the financial jargon and get to what really matters. Here’s your practical guide to understanding YTM – what it is, how to calculate it, and most importantly, how to use it to make smarter investment decisions.

What is Yield to Maturity (YTM)?

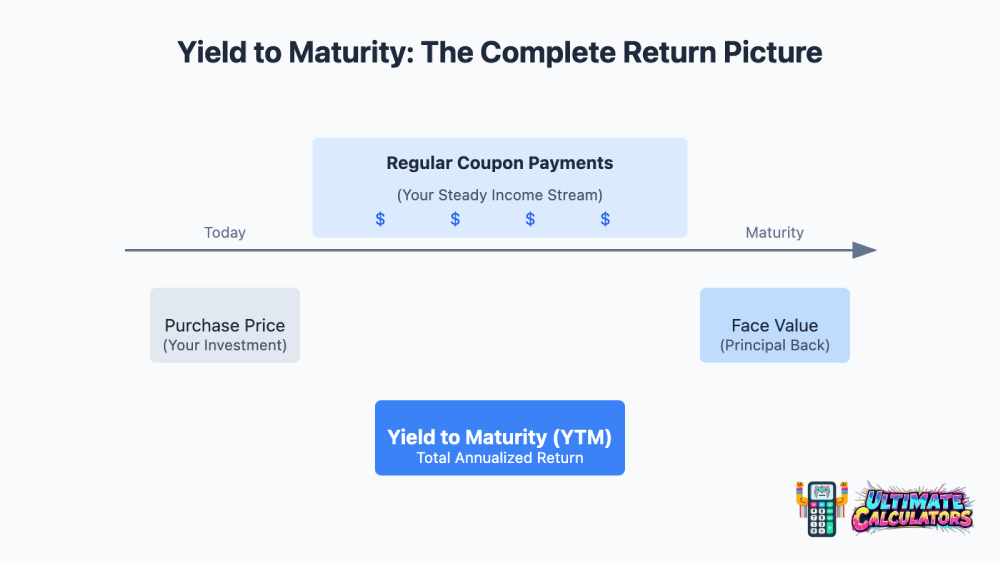

Think of YTM as your “what if” number – specifically, what if you buy this bond today and hold onto it until the bitter end? It’s the total return you’d get, assuming everything goes according to plan (meaning all those promised payments actually show up on time).

YTM represents the bond’s internal rate of return (IRR) if you buy it at today’s market price and hold it until maturity, with all coupon and principal payments arriving as scheduled. The beauty of YTM is that it’s expressed as an annual rate, making it easy to compare bonds that might look completely different on the surface – different coupon rates, prices, maturities, you name it.

Why is Yield to Maturity Important?

Let’s break down why YTM isn’t just another fancy financial acronym:

- Comprehensive Return Measure: Unlike current yield, which only looks at your annual coupon payments relative to price (kind of like just looking at a car’s MPG without considering resale value), YTM gives you the full picture. It includes both your regular coupon income and any gain or loss you’ll see from buying at a discount or premium to face value.

- Bond Comparison: Want to compare a 5-year corporate bond paying 4% with a 10-year municipal bond paying 3%? YTM lets you do exactly that by converting everything to an annualized rate. It’s like having a universal translator for bond returns.

- Investment Decision Making: YTM helps you figure out if a bond’s return is worth its risk and makes sense in the current interest rate environment. Higher YTM usually means better return potential, but (and this is a big but) only if you’re comparing bonds with similar risk profiles.

- Market Insight: When you see YTM changing across the bond market, it’s telling you something about where interest rates are headed and how investors are feeling about fixed income investments. Think of it as the bond market’s mood ring.

How to Calculate Yield to Maturity: The Formula Explained

Don’t let the math scare you off – while YTM calculations can look intimidating at first glance, understanding the formula helps you grasp what’s really going on under the hood. Sure, you’ll probably use a calculator or spreadsheet in real life, but knowing the components matters. Let’s break it down for both regular bonds and their zero-coupon cousins.

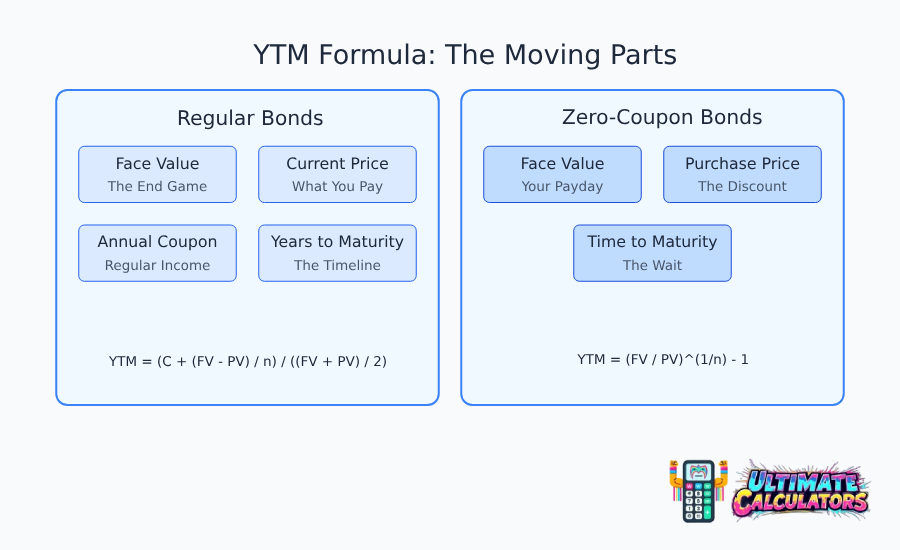

Yield to Maturity Formula for Coupon-Bearing Bonds

Here’s the formula for calculating approximate Yield to Maturity for a regular, coupon-paying bond:

YTM = (C + (FV – PV) / n) / ((FV + PV) / 2)

Where:

- YTM = Yield to Maturity

- C = Annual Coupon Payment (in dollars) – calculated as Coupon Rate * Face Value

- FV = Face Value (Par Value) of the bond

- PV = Present Value (Current Market Price) of the bond

- n = Number of Years to Maturity

Let’s decode each piece:

- Annual Coupon Payment (C): This is your regular paycheck from the bond. Take the coupon rate and multiply it by the face value. A 5% coupon on a $1,000 bond? That’s $50 coming your way each year.

- Face Value (FV): This is what you’ll get back when the bond matures. Usually a nice round number like $1,000 per bond – the bond’s “par value” in market-speak.

- Present Value (PV): What you’d pay for the bond today. This moves around based on market conditions – interest rates go up, bond prices go down, and vice versa. It’s like a financial seesaw.

- Years to Maturity (n): How long until you get your principal back. Simple as that.

Important Note: This formula gives you an approximation – it’s the back-of-the-napkin version that most people use. The actual YTM calculation gets more complex, especially for bonds paying coupons more frequently than annually. But for most practical purposes, this approximation gets you close enough to make informed decisions.

Yield to Maturity Formula for Zero-Coupon Bonds

Zero-coupon bonds are a different animal – no regular interest payments, just buy low and collect face value at maturity. Their YTM formula is actually simpler:

YTM = (FV / PV)^(1/n) – 1

Where the variables mean the same things as above. This formula gives you the annualized compound return based on how much discount you’re getting upfront versus what you’ll collect at maturity.

Yield to Maturity Calculator: Interactive Tool

Look, we all know bond math isn’t exactly anyone’s idea of a good time. That’s why we’ve put together a calculator that does the heavy lifting for you. Just plug in a few numbers, and you’ll get both your YTM and Current Yield faster than you can say “fixed income securities.”

Step-by-Step Guide: Using the Yield to Maturity Calculator

Let’s walk through this thing like we’re actually going to use it (because you are, right?):

- Face Value ($): Start with the basics – how much is this bond supposed to pay back at maturity? Usually $1,000, but always double-check. It’s like measuring twice and cutting once, but with money.

- Annual Coupon Rate (%): This is your interest rate as a percentage. Got a 5% coupon rate? Just type “5” – no need to convert decimals or do any fancy math.

- Years to Maturity: How long until you get your principal back? Just enter the number of years – the calculator handles the rest.

- Current Bond Price ($): What’s the bond trading for right now? You can usually find this on any decent financial website or through your broker.

- Coupon Frequency: Here’s where you tell us how often you’re getting paid – Annually, Semi-Annually, Quarterly, or Monthly. Most corporate bonds are semi-annual, by the way.

- Click “Calculate Yield to Maturity”: The moment of truth. One click and you’ll know if this bond is worth your time.

- View Results: You’ll get two numbers that actually mean something:

- Yield to Maturity (YTM): Your “all-in” return if you hold the bond to maturity

- Current Yield: Just the annual income based on what you’re paying

Example Calculation: Putting it all Together

Let’s run through a real-world example – because theory is great, but practice pays the bills.

Say you’re looking at a bond with these specs:

- Face Value: $1,000

- Annual Coupon Rate: 4%

- Years to Maturity: 5 years

- Current Bond Price: $920

- Coupon Frequency: Semi-Annually

Plug these numbers in and here’s what you get:

- Yield to Maturity (YTM): Approximately 5.88%

- Current Yield: Approximately 4.35%

What’s this telling you?

Well, your YTM (5.88%) is higher than your current yield (4.35%) because you’re buying at a discount – $920 for something that’ll be worth $1,000 at maturity. That extra $80 gets factored into your total return, which is why YTM gives you the fuller picture.

Here’s what these numbers mean in plain English:

- That 5.88% YTM says if you buy at $920 and hold until maturity, you’ll earn about 5.88% annually when you factor in both your coupon payments and that $80 bonus you’ll get at maturity.

- The 4.35% current yield is simpler – it’s just telling you that your $40 annual coupon payments ($1,000 × 4%) divided by your $920 investment gives you a 4.35% annual income return.

Remember, the YTM is higher than the current yield in this case because you’re buying at a discount. That’s usually a good thing – kind of like buying something on sale and knowing exactly when it’ll go back to full price.

Yield to Maturity Formula in Excel

Look, not everyone’s got fancy Bloomberg terminals or specialized bond calculators sitting around. Sometimes you just need to crack open Excel and get it done. Good news – Excel’s got your back with the RATE function. It’s not specifically built for YTM, but with a few tweaks, it’ll do the job just fine.

Here’s your Swiss Army knife for bond calculations:

=RATE(NPER, PMT, -PV, FV)Where:

- NPER: Number of periods (fancy way of saying “years to maturity”)

- PMT: Your coupon payments (annual payment = coupon rate × face value)

- -PV: Current bond price (yes, it needs to be negative – Excel’s quirky like that)

- FV: Face value (what you get back at maturity)

Step-by-Step in Excel

Let’s set this up like we’re actually going to use it (because Excel formulas are like IKEA instructions – better to follow them in order):

- Enter Bond Data: First, let’s get organized. Put your numbers in cells where you can find them:

- Face Value (cell A1)

- Annual Coupon Rate (cell A2)

- Years to Maturity (cell A3)

- Current Bond Price (cell A4)

- Calculate Annual Coupon Payment: In cell A5, type:

=A2*A1

This multiplies your coupon rate by face value. Simple, right? - Apply the RATE Function: Here’s where the magic happens. In your YTM cell, enter:

=RATE(A3, A5, -A4, A1) - Format as Percentage: Right-click that cell and hit percentage format. Nobody wants to see 0.0588 when they could see 5.88%.

Important Considerations for Excel RATE Function

Here’s what they don’t tell you in the Excel help files:

- Approximation: Like that “5-minute” estimate your mechanic gives you, the RATE function is an approximation. It assumes all payments happen at the end of each period, which is close enough for government work (literally – many government analysts use this method).

- Annual Coupons: The basic formula works great for annual payments. But let’s be real – most bonds pay semi-annually. Here’s the fix:

- For semi-annual payments: Double your periods (multiply Years to Maturity by 2) and halve your payments

- For quarterly payments: Multiply periods by 4, divide payments by 4

- For monthly: You get the idea

Example fix for semi-annual payments:

=RATE(A3*2, A5/2, -A4, A1)*2(Multiply the result by 2 at the end to annualize it – because that’s how we talk about yields in the real world)

Remember: There’s no shame in using Excel for this. Sure, there are fancier tools out there, but sometimes you just need to get the job done, and Excel’s sitting right there on your desktop, ready to roll.

Limitations of Yield to Maturity and Important Considerations

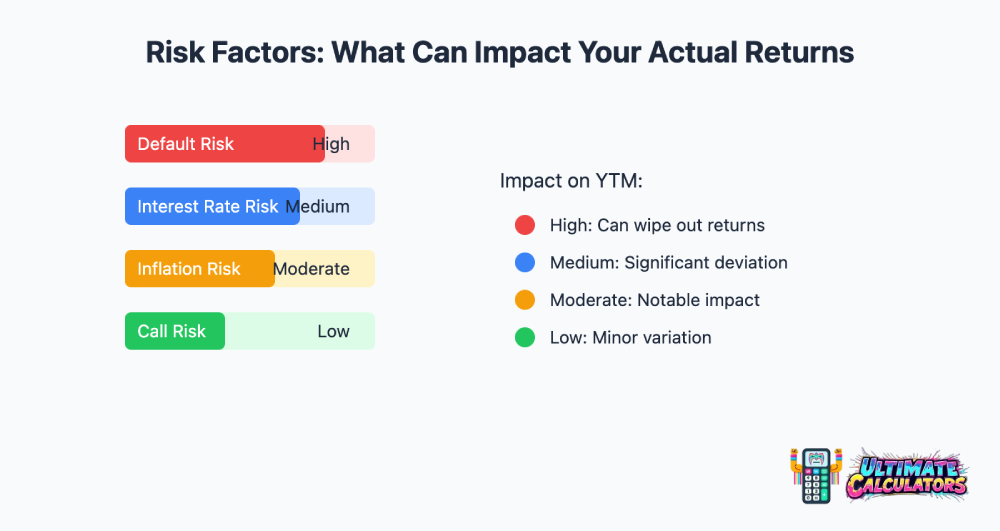

Let’s have a frank conversation about YTM’s blind spots. Look, it’s a great metric – kind of like your car’s MPG rating. Useful? Absolutely. Tell you everything you need to know? Not even close. Here’s what YTM doesn’t tell you, and why it matters:

- Reinvestment Risk: So YTM assumes you can reinvest all those juicy coupon payments at the same rate until maturity. Spoiler alert: You probably can’t. Interest rates are like the weather in Chicago – if you don’t like them, just wait 15 minutes. Your actual returns might end up higher or lower depending on where rates go.

- Default Risk: YTM calculations are like optimists at a party – they assume everything’s going to work out perfectly. In YTM-land, every issuer makes every payment right on schedule. In the real world? Well, let’s just say credit ratings exist for a reason. Want to know your actual risk of not getting paid? Look at credit ratings and spreads, not YTM.

- Call Risk: Here’s a fun one – some bonds come with a “take-backsies” clause (technically called being “callable”). The issuer can basically say “thanks for the loan, here’s your money back” before maturity. Usually happens when interest rates drop and they can refinance cheaper. That YTM you calculated? Goes right out the window. This is why Yield to Call (YTC) exists.

- Interest Rate Risk: Remember that seesaw relationship between bond prices and yields? Well, YTM is just a snapshot – like trying to judge a movie from a single frame. If rates go up, your bond’s price goes down, and vice versa. YTM can’t predict where rates are headed.

- Inflation Risk: YTM is what we call a “nominal” return – it doesn’t account for inflation eating away at your purchasing power like termites in a wooden house. Want to know your real return? Subtract inflation. That 5% YTM doesn’t look so hot when inflation’s running at 4%, does it?

- Liquidity Risk: Some bonds are like New York City apartments – you can buy or sell them anytime. Others are more like that cabin in the woods – might take a while to find a buyer, and you might not love the price. YTM assumes you can sell at fair market value whenever you want. Reality isn’t always so accommodating.

Beyond YTM: The Rest of the Story

When you’re sizing up a bond investment, think of YTM as just one piece of a bigger puzzle. Here’s what else you should be looking at:

- Credit Quality: Those letter grades from Moody’s and S&P aren’t just for show. AAA means sleep-well-at-night quality. The further down the alphabet you go, well… let’s just say higher yields come with higher risks.

- Bond Type: Government, corporate, municipal – each comes with its own quirks and perks. Treasury bonds are like that friend who always shows up on time. Corporate bonds might pay more, but they’re also more likely to “forget” their wallet.

- Maturity and Duration: Longer-term bonds are like boats – the bigger they are, the more they rock when rates change. Duration tells you exactly how seasick you might get when interest rates shift.

- Overall Portfolio: No bond is an island. How does this particular investment fit with everything else you own? Diversification isn’t just a fancy word – it’s your portfolio’s seat belt.

Conclusion: Making Informed Bond Investment Decisions with YTM

Here’s the straight talk on YTM: it’s your best tool for understanding bond returns, but it’s not the only tool you need. Think of it like a laser level – incredibly precise for what it does, but you still need the rest of your toolbox to build something solid.

What makes YTM powerful is its completeness. It captures both your regular coupon payments and that critical spread between your purchase price and maturity value. But just like you wouldn’t buy a piece of equipment based solely on its spec sheet, don’t make bond decisions based on YTM alone.

The smart money looks at the whole picture: credit ratings (because getting paid back matters), market conditions (rates and inflation aren’t getting any more predictable), and portfolio fit (because even the best bond in the world can be the wrong bond for you).

Bottom line: Use YTM as your starting point, not your stopping point. Run the numbers through our calculator, check your assumptions, and remember – in the fixed income world, the highest yield isn’t always the best yield. Sometimes the best returns come from the bonds that let you sleep at night.

FAQ

Calculate yield to maturity (YTM) using the formula:

YTM ≈

C + (F – P) / N

(F + P) / 2

Where:

- C = Annual coupon payment

- F = Face value of the bond

- P = Current bond price

- N = Years to maturity

YTM can also be solved using trial and error or financial calculators.

A good yield to maturity (YTM) depends on risk tolerance and market conditions. Higher YTM indicates higher return potential but also higher risk. Generally, corporate bonds offer 4-7%, while government bonds provide lower but safer returns. A good YTM exceeds inflation and matches an investor’s required rate of return.

A 7% coupon bond with a $1,000 face value pays $70 annually. Coupon interest is calculated as:

Annual Interest = Coupon Rate × Face Value

Annual Interest = 0.07 × 1000 = 70

Investors receive $70 per year until maturity.

The bond value is calculated using the present value of future cash flows:

P = ∑ C / (1 + r)t + F / (1 + r)N

Where:

- C = 40 (Annual coupon: 4% of $1000)

- r = 5% = 0.05 (Yield to maturity)

- F = 1000 (Face value)

- N = 20 (Years to maturity)

Using a financial calculator, the bond price is approximately $828.40.

Yield to Maturity Calculator: Calculate Bond YTM Formula Solutions Tailored to Real Life 🧮

- Deliver results you can actually trust

- Effective ways to crunch complex numbers

- Calculator solutions that make sense for humans

The Numbers Don't Lie:

Why People Actually Use Ultimate Calculators

We built these tools because we got tired of calculators that either oversimplify the math or make you feel like you need an engineering degree to get an answer. Whether you're planning a project or just trying to figure out what something will cost, our calculators give you the straight numbers without the runaround.

Real Reviews From Real Humans

"Finally, a calculator that doesn't make me guess what half the fields mean. Got my answer in 30 seconds."

Mike RodriguezHomeowner - Denver, CO

Mike RodriguezHomeowner - Denver, CO

100% Free Calculations

Our math works, our prices don't

24/7 Calculator Access

Crunch numbers whenever you need

100% Accurate Results

We double-check our math so you don't have to