Compound Interest Calculator: Turn Your Money into a Money-Making Machine (2026)

The compound interest formula is: A=P(1+r/n)nt where: A is the final amount, P is the principal, r is the annual interest rate (decimal), n is the number of times interest compounds per year, t is the time in years.

Compound Interest Calculator

???? Compound Interest Calculator

Calculate the future value of your investments with compound interest.

| Year | Start Balance | Interest Earned | End Balance |

|---|

Power Tools: Calculator Quick Guides & Pro Tips

Get the most from your calculations in under 60 seconds:

Principal: Start with what you’ve actually got, not what you wish you had. Even small amounts can grow impressively.

Interest Rate: Use real-world numbers:

- High-yield savings: 3-5%

- Stock market (historical average): 7-10%

- Pro tip: When in doubt, use 7% for long-term stock market calculations

Time Horizon: Longer is stronger. Each extra year supercharges your returns.

Quick Check: If your result seems too good to be true, double-check your interest rate – the most common mistake is entering 50 instead of 0.50!

Your number looks impressive, but what’s it really telling you?

Rule of 72: Divide 72 by your interest rate to estimate years until your money doubles.

Reality Check:

- Under $100k? You’re building a safety net

- $100k-$500k? Hello, house down payment

- $500k-$1M? Now we’re talking retirement

- Over $1M? Welcome to financial independence

Remember: These are pre-tax numbers. For after-tax estimates, knock about 20% off.

Level up your compound interest game:

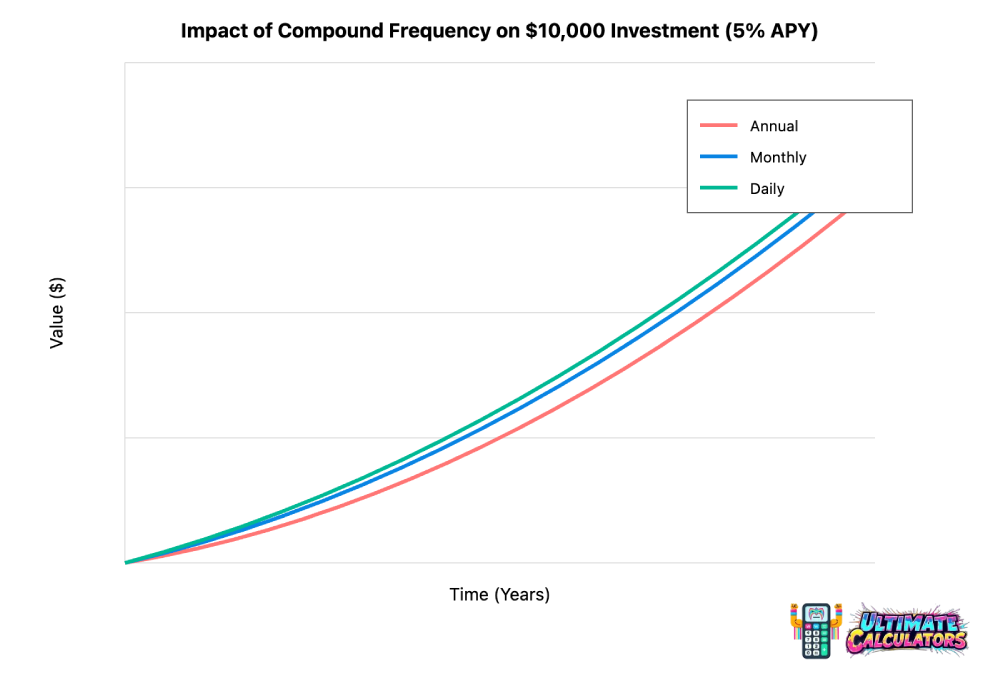

Compounding Frequency Sweet Spots:

- Monthly is your friend (most real-world investments)

- Daily looks fancy but adds minimal gains

- Quarterly works for dividend stocks

Pro Tips: Match your inputs to real products:

- IRAs/401(k)s → Monthly compounding

- CDs → Usually quarterly

- High-yield savings → Daily

- Stocks → Assume monthly for simplicity

Three steps to financial clarity:

- Input Basics:

- Starting amount (what you have now)

- Interest rate (be realistic – no 50% returns!)

- Time period (longer = more magic)

- Fine-Tune:

- Add inflation rate for real-world numbers

- Pick monthly compounding for most scenarios

- Toggle between yearly/monthly views

- Interpret: Check both nominal and real returns. The difference? That’s inflation eating your lunch.

Pro Tip: Save your calculations by bookmarking or screenshots – great for comparing different scenarios.

Details

- by Rhett C

- Updated August 25, 2025

- Add to your website

Why send your precious traffic to a 🤬 competitor when customers can crunch numbers right on your turf?

Fill out this quick form (takes 37 seconds, we timed it) & your custom calculator zooms into your inbox faster than you can say “conversion rate 💥”.

What is Compound Interest and Why Does It Matter?

They call compound interest the “eighth wonder of the world,” and trust me, it’s not just marketing hype. Think of it as a financial feedback loop – you earn interest on your initial investment, that interest gets added to your pot, and then you start earning interest on that bigger amount. Rinse and repeat, and watch your money multiply.

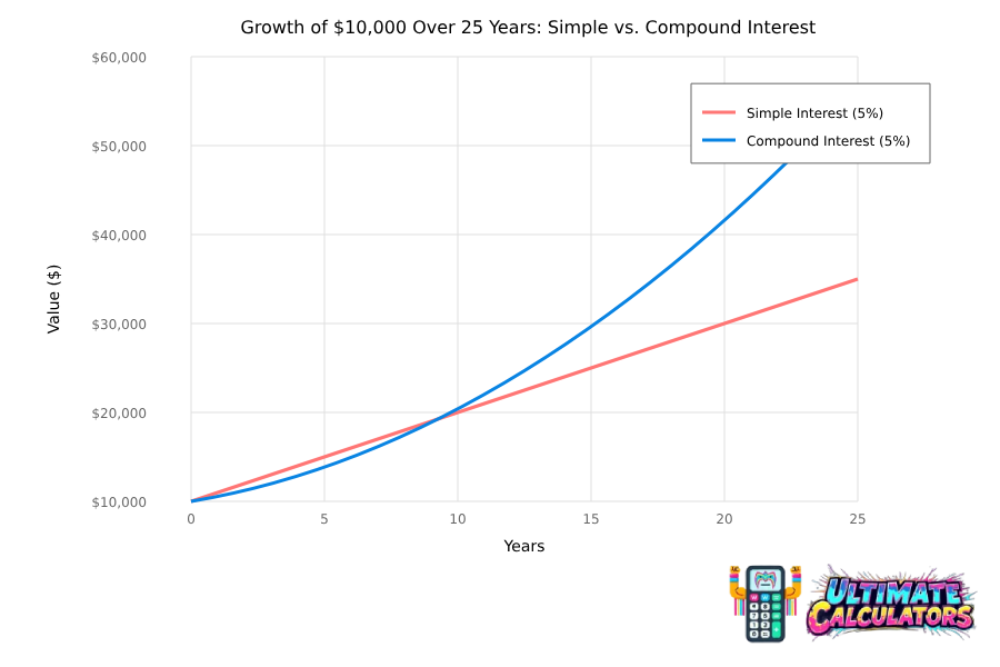

The Magic of Compounding: Interest on Interest

Let’s break this down with a garden analogy (because who doesn’t love plants that actually make you money?). Your initial investment is like planting a seed – that’s your principal. The interest rate is your sunlight and water – the good stuff that makes it grow. With simple interest, you’re just getting growth on that original seed, year after year. Pretty basic stuff.

But compound interest? Now that’s where it gets interesting. Your seed grows into a plant, and next year you’re not just getting growth on the original seed – you’re getting growth on the whole plant. The base you’re earning interest on keeps getting bigger, which means your returns start to snowball. That’s the exponential growth everyone’s always talking about.

Why Compound Interest is Crucial for Long-Term Wealth

Whether you’re dreaming about retirement, eyeing that future dream house, or planning to fund your kid’s college education, compound interest is your ticket to getting there. It’s like having a tireless employee who works 24/7, even while you’re sleeping, making your money work harder and smarter.

The real kicker? Time is your best friend here. The longer your money compounds, the more dramatic the effects become. Even modest savings, when given enough time to compound, can grow into impressive sums. Try to build long-term wealth without understanding compound interest, and you’re like an architect trying to design a skyscraper without factoring in gravity – it’s just not going to work out well.

Breaking Down the Compound Interest Formula

Look, I know what you’re thinking – “Oh great, here comes the math.” But stick with me here, because understanding this formula is like getting the cheat codes to building wealth. It’s actually pretty straightforward once we break it down into bite-sized pieces.

Key Components: Principal, Interest Rate, Time, Compounding Frequency

Think of these components as the ingredients in your wealth-building recipe. Just like baking, each one plays a crucial role, and getting the mix right makes all the difference.

Here’s what we’re working with:

- Principal (P): This is your starter money – the initial investment you’re kicking things off with. Think of it as your financial seed money.

- Annual Interest Rate (r): The percentage rate your money grows each year. And here’s a pro tip – even if you’re compounding more often than annually, this rate is typically expressed as a yearly figure. So if someone quotes you a monthly rate, make sure you’re comparing apples to apples.

- Time (t): How long you’re letting your money do its thing, usually in years. Remember what we said about time being your friend? This is where that magic happens.

- Compounding Frequency (n): How often your interest gets calculated and rolled back into your principal. Could be annually, monthly, daily – heck, some investments even compound continuously. More frequent compounding means faster growth, though the difference might be smaller than you’d expect.

The Formula Explained: A = P(1 + r/n)^(nt)

Alright, here it is – the recipe for wealth building. Don’t let it intimidate you:

A = P(1 + r/n)^(nt)

Where:

- A = What your investment grows to (the future value)

- P = Your initial investment (principal)

- r = Annual interest rate (as a decimal)

- n = Number of times interest compounds per year

- t = Number of years invested

Now, I know this looks like something from your high school algebra nightmare, but here’s what’s actually happening: (1 + r/n) calculates your growth for one compounding period. When we raise that to the power of (nt), we’re essentially saying “do this over and over for all your compounding periods.” Then we multiply by P to scale it to your initial investment.

Think of it like this – if you’re baking a cake (P), the recipe (1 + r/n) tells you how much it rises in one interval, and the number of intervals (nt) tells you how many times this happens. The end result (A) is your fully risen cake – except in this case, it’s your fully grown investment.

Example Calculation: Seeing Compound Interest in Action

Alright, enough theory – let’s run some real numbers. Because nothing beats seeing your money multiply like rabbits in springtime.

Let’s say you’ve got $10,000 burning a hole in your pocket (P), and you’re looking at an investment paying 5% annually (r). We’ll compound it annually (n=1) and let it ride for 10 years (t). Here’s where the rubber meets the road:

Using our trusty formula:

A = 10000 * (1 + 0.05/1)^(1*10)

A = 10000 * (1.05)^10

A ≈ $16,288.95Hold up – you just made over $6,288 without lifting a finger. That’s the power of compound interest doing the heavy lifting for you.

But let’s break this down year by year, because that’s where you really see the compounding magic happen:

| Year | Starting Balance | Annual Contribution | Interest Earned | Ending Balance | Cumulative Interest |

|---|---|---|---|---|---|

| 1 | $10,000.00 | $0.00 | $500.00 | $10,500.00 | $500.00 |

| 2 | $10,500.00 | $0.00 | $525.00 | $11,025.00 | $1,025.00 |

| 3 | $11,025.00 | $0.00 | $551.25 | $11,576.25 | $1,576.25 |

| 10 | … | $0.00 | … | $16,288.95 | $6,288.95 |

See what’s happening here? Each year, your interest earned keeps getting bigger. Why? Because you’re earning interest on a growing pile of money. Year 1, you earned $500 on your $10,000. By Year 2, you’re earning $525 because now you’ve got $10,500 working for you. And it just keeps snowballing from there.

How to Use a Compound Interest Calculator Effectively

Look, while understanding the formula is great for impressing people at parties (you go to some weird parties), a compound interest calculator is your day-to-day workhorse for projecting investment growth. Plus, it lets you play around with different scenarios without having to dust off your high school algebra skills.

Input Fields Explained: Principal, Rate, Time, Compounding, Contributions

A solid compound interest calculator is going to ask you for a few key pieces of information. Think of it like ordering a coffee – you need to specify exactly what you want to get what you’re looking for:

- Initial Investment Amount (Principal): Be realistic here. No judgment, but “winning the lottery” isn’t a reliable investment strategy.

- Annual Interest Rate: What kind of return are you expecting? Different investments come with different rates – and usually, higher potential returns mean higher risk. Do your homework on typical rates for your investment type.

- Years to Grow (Time Period): How long can you let this money do its thing? Remember, time is compound interest’s best friend. The longer you can leave it alone, the more impressive the results.

- Compounding Frequency: How often does your interest get reinvested? Annual is common, but monthly or even daily compounding can juice your returns a bit more.

- Annual Contribution (Optional): Planning to add more money regularly? Many calculators let you factor this in. Regular contributions are like strapping a turbocharger to your compound interest engine.

Interpreting Your Results: Future Value and Interest Earned

Look, anyone can punch numbers into a calculator, but knowing what those numbers actually mean for your financial future? That’s where the rubber meets the road. Let’s break this down into something you can actually use.

When your calculator spits out those numbers, you’re looking at two key pieces of intel:

- Future Value (Final Balance): This is your money’s final form, like a Pokemon that’s fully evolved. It includes everything – your initial investment plus all that compound interest you’ve been racking up. Think of it as your financial high score.

- Total Interest Earned: Here’s the real eye-opener – this shows you exactly how much money your money made for you. When you see this number, you’ll understand why investors get that gleam in their eye when talking about compound interest.

Scenario Planning: Using the Calculator for “What-If” Analysis

Here’s where things get interesting – and by interesting, I mean potentially life-changing. The real power of a compound interest calculator isn’t just running one set of numbers; it’s playing out different scenarios to see what’s possible.

Want to know what happens if you:

- Bump up your initial investment?

- Score a slightly better interest rate?

- Keep your money in the game a few years longer?

- Add a monthly contribution to the mix?

Just tweak those inputs and watch what happens. It’s like having a financial crystal ball, except this one’s backed by math instead of magic.

The beauty of scenario planning is that it lets you:

- Set savings goals that actually make sense

- See how different investment choices stack up

- Figure out if you’re being too conservative (or too aggressive)

- Understand what those “small” changes in interest rates really mean over time

Pro tip: Run at least three scenarios for any major financial decision:

- Your base case (what you think will happen)

- Your conservative case (if things don’t go quite as planned)

- Your stretch case (if everything clicks)

I’ve seen too many folks get burned by only looking at best-case scenarios, and just as many miss opportunities by being too pessimistic. The sweet spot is understanding the range of possibilities and planning accordingly.

Here’s the thing about all these projections – they’re not just academic exercises. They’re planning tools that can help you make better decisions today. Maybe you’ll see that starting five years earlier makes a bigger difference than doubling your monthly contribution. Or that hunting for an extra 1% return might not be worth the added risk. That’s the kind of insight that turns good intentions into actual results.

Remember: The goal isn’t to predict the future perfectly (good luck with that). It’s to understand how different choices today might play out tomorrow, so you can make smarter decisions with your money right now.

Strategies to Maximize Your Compound Interest

Alright, now that we’ve got the theory down, let’s talk turkey about how to actually make compound interest work its magic for you. No fancy jargon, just straight talk about what actually works.

graph LR

subgraph "Early Start: Sarah"

A["Age 25<br>$100/month"] --> B["Age 45<br>$100/month"] --> C["Age 65<br>$200,000+"]

style A fill:#90EE90,stroke:#333,stroke-width:2px

style B fill:#90EE90,stroke:#333,stroke-width:2px

style C fill:#90EE90,stroke:#333,stroke-width:2px

end

subgraph "Late Start: Mike"

D["Age 35<br>$200/month"] --> E["Age 50<br>$200/month"] --> F["Age 65<br>$160,000"]

style D fill:#FFB6C1,stroke:#333,stroke-width:2px

style E fill:#FFB6C1,stroke:#333,stroke-width:2px

style F fill:#FFB6C1,stroke:#333,stroke-width:2px

endStart Early: Time is Your Greatest Asset

Look, I’m about to tell you something that might sting if you’re not in your 20s anymore, but it needs to be said: Time is the heavyweight champion of wealth building, and it’s not even close.

Here’s the thing about starting early – it’s not just a little better, it’s exponentially better. I’ve seen folks try to make up for lost time by throwing bigger numbers at their investments later in life, and let me tell you, it’s like trying to catch a bullet train on a bicycle. Can it be done? Sure. Is it the way you want to do it? Not if you can help it.

Let me put this in real terms: Starting at 25 and investing $100 a month can actually net you more than starting at 35 and investing $300 a month, assuming the same return rate. That’s not a typo – you can invest three times as much money but end up with less just because you started a decade later. If that doesn’t make you sit up straight, I don’t know what will.

Save Consistently: Regular Contributions Boost Growth

Here’s another truth bomb: Consistency beats intensity every time in the compound interest game. Think of it like growing a garden – regular watering beats occasional flooding.

You know what’s better than a one-time $5,000 investment? Monthly $100 contributions. Yeah, I know the math doesn’t add up in terms of total dollars invested, but that’s the beauty of compound interest – it rewards the marathon runner, not the sprinter.

Set up automatic transfers if you have to. Treat it like a bill that has to be paid. Because here’s the dirty little secret about compound interest that nobody talks about: it works against you just as effectively as it works for you. (Looking at you, credit card debt.)

Choose Investments Wisely: Balancing Risk and Return

Now let’s talk about something that makes people squirm – risk versus return. Everyone wants those juicy double-digit returns, but nobody wants to talk about what it takes to get them.

Here’s the real deal on investment returns:

- Savings accounts and CDs: Safe as houses, returns like a bicycle

- Bonds: Less safe, slightly better returns, still not winning any races

- Stock market index funds: Now we’re talking – historically better returns, but pack your motion sickness pills

- Individual stocks: Higher potential returns, but also higher potential for “well, that was a bad idea”

Pro tip: Your risk tolerance should match your time horizon. Young with decades to invest? You can afford to be aggressive. Five years from retirement? Maybe dial it back a bit.

And for heaven’s sake, diversify. I don’t care how much you love Apple or Tesla – putting all your eggs in one basket is a rookie move, and you’re better than that.

Reinvest Your Earnings: Let Compound Interest Work its Magic

Here’s where people often shoot themselves in the foot – they see those dividends or interest payments come in and think “shopping money!”

No. Just… no.

The whole point of compound interest is to earn interest on your interest. Every time you skim off those earnings, you’re basically resetting the compound interest clock. It’s like trying to build a snowball while constantly shaving off the outer layer – you’re working against yourself.

Instead, set up automatic reinvestment of dividends and interest. Let your money make money, which makes more money, which makes even more money. That’s how you build a snowball that can eventually turn into an avalanche of wealth.

The Impact of Inflation on Compound Interest (and Real Returns)

Alright, let’s talk about the elephant in the room that nobody likes to mention at investment seminars – inflation. You know, that sneaky force that makes your coffee cost more every year and turns your “amazing” returns into something a bit less Instagram-worthy.

Look, compound interest is great at making your money grow, but inflation is like that roommate who keeps eating your groceries – it’s constantly nibbling away at your purchasing power. We need to talk about this because ignoring inflation is like measuring a football field with a rubber band – your numbers might look good, but they’re not telling the whole story.

Nominal vs. Real Returns: Understanding Inflation’s Role

Time for some real talk about returns, folks. When your investment calculator spits out those juicy numbers, it’s giving you what we call “nominal returns” – that’s the headline number that looks great at parties but doesn’t tell the whole story.

Think of it this way:

- Nominal return = What your statement shows

- Real return = What you can actually buy with that money

Here’s a reality check that might sting a bit: If your investments grew by 5% last year, but inflation was running at 3%, your real return was only 2%. Yeah, I know – math is cruel sometimes.

Let me put this in burger terms: If your money doubles over 20 years, but the price of a burger triples during that same time, did you really come out ahead? This is why we need to think in terms of purchasing power, not just raw numbers.

Using the Inflation-Adjusted Compound Interest Calculator

Here’s where we get smart about this. Instead of just running standard compound interest calculations and crossing our fingers, we’re going to factor in inflation from the start. Because let’s be honest – knowing your real future purchasing power is a lot more useful than having a big number that looks good on paper but buys less than you hoped.

When you’re using an inflation-adjusted calculator:

- Input your expected nominal return rate (the straight investment return)

- Add your estimated inflation rate (historically around 2-3% in most developed economies, but hey, times they are a-changing)

- Let the calculator show you both nominal and real future values

The difference between these numbers? That’s your reality check. That’s what tells you if you need to:

- Save more (nobody’s favorite answer, but sometimes it’s necessary)

- Invest more aggressively (while staying within your risk tolerance, of course)

- Adjust your future expectations (better to know now than be surprised later)

Pro tip: When someone tells you about their amazing investment returns, always ask if they’re quoting nominal or real returns. The difference between “I made 8%” and “I made 8% after inflation” is like the difference between a regular burger and a quarter-pounder – they might sound similar, but one’s got a lot more meat to it.

Remember: Planning for inflation isn’t being pessimistic – it’s being realistic. And in the investment world, realism beats optimism every time. Because at the end of the day, your retirement isn’t going to be funded by nominal returns – it’s going to be funded by what those returns can actually buy.

Compound Interest Calculator: Calculate Your Financial Future Now

You know what’s better than reading about compound interest? Playing with the numbers yourself. It’s like the difference between reading about driving and actually getting behind the wheel. Let’s get you in the driver’s seat.

Go ahead, punch in some numbers. Try different scenarios. Trust me, it’s more fun than it sounds, especially when you start seeing those bigger numbers roll in. Think of it as a financial video game where you actually get to keep the high score in real life.

Further Resources and Tools for Compound Interest

So you’ve caught the compound interest bug and want to dive deeper? I’ve got you covered. Here’s where to go next, depending on how far down this rabbit hole you want to go.

Recommended Reading and Articles

Look, I could tell you to read every financial textbook ever written, but let’s be real – you’ve got a life to live. Here’s the short list of stuff that’s actually worth your time:

- Investopedia’s Compound Interest Definition: The folks at Investopedia break this down better than your high school math teacher ever did. It’s like the Cliff Notes for financial concepts, but actually useful.

- The SEC’s Investor.gov Compound Interest Calculator: Because if you’re going to trust someone’s math, might as well be the folks who regulate the whole show. Plus, their calculator doesn’t try to sell you anything.

- Long-term investing strategies articles from reputable sources: Because knowing how compound interest works is one thing – knowing how to actually use it in the real world is another ball game entirely.

Excel Formula for Compound Interest

For you spreadsheet warriors out there (you know who you are), here’s how to calculate this stuff in Excel or Google Sheets. Because sometimes you want to get your hands dirty with the numbers.

The magic formula is:

=FV(rate/compounding_periods, compounding_periods*years, -periodic_contribution, -principal)Pro tip: Those negative signs aren’t typos. Excel’s FV function assumes you’re paying money out, so we flip the signs to show we’re investing it instead.

Remember, though – a formula is just a formula. What matters is how you use it. I’ve seen people build some pretty sweet retirement planning spreadsheets with this bad boy, complete with Monte Carlo simulations and everything. (Yeah, that’s a real thing, not just something they made up for “The Big Short.”)

And here’s a secret the financial advisors don’t want you to know: You can build a perfectly good investment tracking spreadsheet yourself. Is it going to be as pretty as their software? Probably not. Will it get the job done? Absolutely.

The point isn’t to get fancy with your tools – it’s to understand what’s happening with your money and make informed decisions. Whether you’re using a high-end financial planning suite or a spreadsheet you cobbled together on your lunch break, the principles are the same. Compound interest doesn’t care what calculator you use – it just keeps doing its thing, like gravity or that one friend who always shows up when there’s free food.

Conclusion: Harnessing the Power of Compound Interest for Financial Success

Here’s the thing about compound interest that nobody tells you at fancy investment seminars: It’s a bit like gravity. It’s always working, whether you’re paying attention to it or not. The only question is whether it’s working for you or against you.

I’ve spent two decades watching people either harness this force or ignore it entirely. The ones who get it? They’re the ones retiring early, buying vacation homes, or just sleeping better at night. The ones who don’t? Well, they’re the ones still wondering why their “high-yield” savings account isn’t making them rich.

The secret isn’t in some complex formula or high-priced investment strategy. It’s in three simple principles:

- Start early, even if it’s small (time beats timing every single day of the week)

- Stay consistent (regular small contributions beat sporadic large ones)

- Reinvest everything (let your money’s children and grandchildren keep working for you)

So here’s your homework: Take one action today. Just one. Set up that automatic investment transfer. Run your real numbers through a calculator. Have that conversation about starting now instead of “someday.”

Because here’s the brutal truth: The eighth wonder of the world doesn’t care about your excuses. It just keeps compounding, with or without you.

FAQ

Compound interest is calculated using the formula A = P(1 + r)^n. A is the final amount, P is the principal balance, r is the annual interest rate, and n is the number of years. This formula accounts for interest earned on both the initial principal and accumulated interest from previous periods.

$1000 invested at 6% compound interest for 2 years would be worth $1123.60. The calculation is: 1000 * (1 + 0.06)^2 = 1123.60. This amount includes the initial $1000 principal plus $123.60 in compound interest earned over the two-year period.

Yes, there are two main formulas for compound interest. The first is A = P(1 + r)^n for simple calculations. The second is A = P(1 + r/m)^(nm) for more complex scenarios where m represents the number of times interest is compounded per year.

To calculate compound interest for three years, start by using the formula A = P(1 + r)ⁿ. Substitute the principal (P), the annual interest rate as a decimal (r), and the number of years (n = 3). After obtaining the amount (A), subtract the initial principal (P) from that result to find the compound interest earned.

Compound Interest Calculator: Turn Your Money into a Money-Making Machine (2026) Solutions Tailored to Real Life 🧮

- Deliver results you can actually trust

- Effective ways to crunch complex numbers

- Calculator solutions that make sense for humans

The Numbers Don’t Lie:

Why People Actually Use Ultimate Calculators

We built these tools because we got tired of calculators that either oversimplify the math or make you feel like you need an engineering degree to get an answer. Whether you’re planning a project or just trying to figure out what something will cost, our calculators give you the straight numbers without the runaround.

Real Reviews From Real Humans

“Finally, a calculator that doesn’t make me guess what half the fields mean. Got my answer in 30 seconds.”

Mike RodriguezHomeowner – Denver, CO

Mike RodriguezHomeowner – Denver, CO

100% Free Calculations

Our math works, our prices don’t

24/7 Calculator Access

Crunch numbers whenever you need

100% Accurate Results

We double-check our math so you don’t have to