US Tax Calculator

The US tax calculator formula depends on income brackets, deductions, and credits. Federal income tax follows a progressive system with rates ranging from 10% to 37%. The formula is: Taxable Income = Gross Income – Deductions and Tax Owed = (Income in Each Bracket × Corresponding Tax Rate) – Credits. For precise calculations, IRS tax tables and any applicable state taxes should be consulted.

US Tax Calculator

US Federal Income Tax Calculator

Estimate your federal income tax liability for 2024-2025

Estimated Tax Breakdown

Personalized Tax Saving Tips

Beyond the Numbers: Your Tax Calculator Field Guide

Quick! Grab these 3 numbers (yes, just 3) and let’s roll:

- Your total yearly income (bonus and side hustles included)

- Your filing status (single, married, etc.)

- Any itemized deductions (or just skip this – most folks do)

That’s it! The calculator handles all the heavy lifting. Pop in these numbers and watch the magic happen.

Plot twist: Your tax rate isn’t what you think it is.

Here’s the scoop:

Marginal Rate: That scary-looking percentage in your highest bracket. If you’re seeing 22%, don’t panic – it only applies to your last few dollars earned.

Effective Rate: Your actual tax rate (and the number you want to quote at parties). Usually WAY lower than your marginal rate. Why? Because Uncle Sam gives you a discount on your first chunks of income.

Quick Example: On $75,000, your marginal rate might be 22%, but you’re probably paying closer to 15% overall. Not bad, right?

Your Results Decoded:

- Federal Tax: The big one – your contribution to Uncle Sam’s piggy bank

- FICA: Social Security and Medicare’s cover charge (flat 7.65% for most folks)

- State Tax: Varies wildly (looking at you, California) or doesn’t exist (hat tip, Texas)

- Effective Rate: Your real tax rate – like your GPA for taxes

Seeing a bigger number than expected? Scroll down to our deductions section. There might be some money hiding in plain sight.

Three Ways to Work This Calculator:

Basic Check: Just pop in your income and filing status. Done in 30 seconds.

What-If Mode: Play with different scenarios. Getting married? Changing jobs? Test drive your tax future.

Pro Move: Add itemized deductions if you’ve got them. Think mortgage interest, charitable giving, or that home office setup.

Pro Tip: Save your results! Screenshot or bookmark. Tax planning is a lot easier when you can compare scenarios.

Details

- by ofs

- Updated August 25, 2025

- Add to your website

Why send your precious traffic to a 🤬 competitor when customers can crunch numbers right on your turf?

Fill out this quick form (takes 37 seconds, we timed it) & your custom calculator zooms into your inbox faster than you can say “conversion rate 💥”.

What is a US Tax Calculator and How Does it Work?

Think of a US Tax Calculator as your financial crystal ball – except instead of vague prophecies, it gives you concrete estimates of your federal tax liability. It’s essentially a digital sherpa guiding you through the mountain of tax calculations, showing you what you might owe Uncle Sam or what refund check might be heading your way.

graph TD

A[Your Gross Income] -->|Step 1| B{Choose Your Path}

B -->|Standard| C[Standard Deduction]

B -->|Itemized| D[Itemized Deductions]

C --> E[Calculate Taxable Income]

D --> E

E --> F[Apply Tax Brackets]

F --> G[Final Tax Liability]

style A fill:#a8e6cf,stroke:#3b6978,stroke-width:2px

style B fill:#dcedc1,stroke:#3b6978,stroke-width:2px

style C fill:#ffd3b6,stroke:#3b6978,stroke-width:2px

style D fill:#ffd3b6,stroke:#3b6978,stroke-width:2px

style E fill:#ffaaa5,stroke:#3b6978,stroke-width:2px

style F fill:#ff8b94,stroke:#3b6978,stroke-width:2px

style G fill:#98ddca,stroke:#3b6978,stroke-width:2pxBut before we get too excited about those potential refunds, let’s understand what these calculators are actually doing behind the scenes.

Core Inputs: Income, Filing Status, and More

To work its magic, a US Tax Calculator needs some key pieces of your financial puzzle. Here’s what you’ll typically need to provide:

● Annual Household Income: This is your starting point – the total gross income your household expects to earn in a tax year. Think of it as the foundation the calculator builds everything else on. This number helps determine which tax brackets you might be waving at as you climb the income ladder.

● Filing Status: Are you flying solo (single), teaming up with a spouse (married filing jointly), going your separate ways at tax time (married filing separately), or holding down the fort as head of household? Your choice here is crucial because it affects everything from your tax brackets to your standard deduction amounts.

● State of Residence (Optional): Some calculators want to know where you call home. This helps estimate your state income tax liability, if applicable. Just remember – state tax calculations can be trickier than a game of Jenga, so consider these numbers a rough sketch rather than a photograph.

● Itemized Deductions (Optional): For the overachievers out there, more advanced calculators let you input itemized deductions. These are specific expenses the IRS allows you to deduct from your taxable income – think medical expenses that made your wallet hurt, mortgage interest payments, or those charitable donations you made (because you’re just that kind of person). If you don’t itemize, no worries – you’ll typically take the standard deduction, which is like the tax equivalent of the “easy button.”

The Calculation Engine: From Gross Income to Taxable Income

Ever wonder what happens in the digital sausage factory once you feed your numbers into a tax calculator? Let’s pop the hood and see what’s really going on in there. The “calculation engine” is basically following the same steps your accountant would, just without the coffee breaks.

graph TD

A[State Tax Systems] --> B[No Income Tax]

A --> C[Flat Tax]

A --> D[Progressive Tax]

B --> E[FL, TX, WY, etc.]

C --> F[IL, MI, PA, etc.]

D --> G[CA, NY, NJ, etc.]

style A fill:#34495e,color:#fff

style B fill:#2ecc71,color:#fff

style C fill:#e74c3c,color:#fff

style D fill:#f1c40f

style E fill:#a8e6cf

style F fill:#ff8b94

style G fill:#ffd3b6Here’s how your numbers journey through the calculator’s brain:

- Gross Income: This is your starting point – every dollar you earned, before Uncle Sam gets his piece of the pie. The calculator takes this number and says, “Okay, let’s see what we can do with this.”

- Adjustments to Income (Simplified): Here’s where things get interesting. In the real tax world, you get certain “above-the-line” deductions that can reduce your gross income to get your Adjusted Gross Income (AGI). Think traditional IRA contributions or that student loan interest you’re still paying off. Basic calculators might skip this step or make some assumptions – they’re more “back-of-the-napkin” than “full accounting department.”

- Deductions: Now we’re at the fork in the road – standard deduction or itemized? The calculator looks at both options and picks whichever saves you more money. It’s like having a friend who always knows the better deal. The standard deduction is that “take it and run” option that changes based on your filing status and gets a yearly update from the IRS.

- Taxable Income: After subtracting your deductions from your (adjusted) gross income, you get your taxable income. This is the number that actually matters when it comes to calculating your tax bill.

- Applying Tax Brackets: Finally, the calculator applies the tax brackets to your taxable income. Think of it like a progressive toll road – the first few miles are cheap, but the rates go up the further you drive.

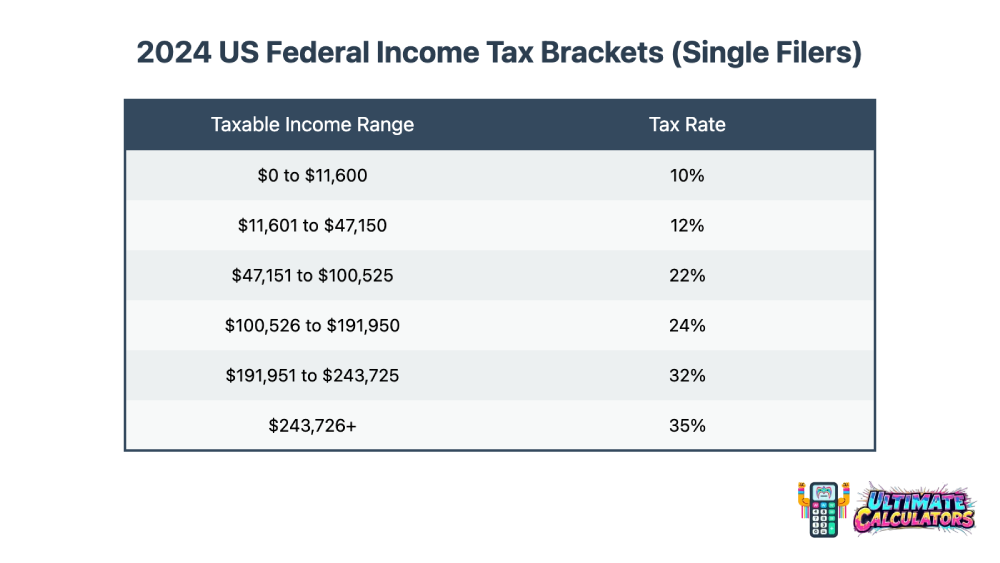

Understanding Tax Brackets and Marginal Rates

Let’s talk about everyone’s favorite topic: tax brackets. The US tax system is progressive, which means it works kind of like a layer cake – each layer gets taxed at a different rate.

For 2024, if you’re filing single, here’s how your income gets sliced:

| Taxable Income | Rate |

|---|---|

| $0 to $11,600 | 10% |

| $11,601 to $47,150 | 12% |

| $47,151 to $100,525 | 22% |

| $100,526 to $191,950 | 24% |

Here’s the thing about tax brackets that trips up even seasoned pros: they’re marginal rates. That means each rate only applies to the income within that bracket. It’s not an all-or-nothing deal.

Let’s break it down with a real-world example. Say you’re single with a taxable income of $50,000. Here’s how the math actually works:

● You pay 10% on the first $11,600

● Then 12% on the chunk from $11,601 to $47,150

● Finally, 22% on what’s left up to $50,000

The calculator does all this math automatically, saving you from having to bust out your old algebra skills. Your marginal rate (22% in this case) only applies to those last few dollars – not the whole enchilada. That’s why your actual tax rate (what we call the effective rate) ends up being lower than your marginal rate.

Decoding Your Tax Calculator Results: Key Metrics Explained

So your tax calculator just spit out a bunch of numbers, and you’re sitting there wondering if you should break out the champagne or the tissue box. Let’s decode what all these figures actually mean for your wallet.

Federal Income Tax: Your Estimated Liability

First up, we’ve got your estimated federal income tax – the headline number everyone loves to hate. This is the calculator’s best guess at what you’ll owe Uncle Sam come tax time, based on the information you fed it. Think of it like a weather forecast for your wallet: generally reliable, but don’t bet the farm on it being exact to the penny.

It’s presented in plain dollars and cents, calculated using those tax brackets we talked about earlier. Remember though – this is an estimate. Your actual tax bill might look different once you file your return with all the bells and whistles the IRS loves so much.

Effective Tax Rate vs. Marginal Tax Rate: What’s the Difference?

Here’s where things get interesting. Your tax calculator probably shows you two different rates, and no, it’s not just to make your head spin. Let’s break them down:

● Marginal Tax Rate: This is like your tax bracket’s cover charge – it’s the rate you’ll pay on your next dollar of income. Say you’re in the 22% bracket – that doesn’t mean Uncle Sam is taking 22% of everything (no matter what your uncle claims on Facebook). It’s just the rate on your last few dollars earned and any additional income you might make.

● Effective Tax Rate: Now this is the number you want to know at parties. Take your total tax bill and divide it by your total income – boom, that’s your effective rate. It’s usually way lower than your marginal rate because of our progressive tax system. Someone with a 22% marginal rate might have an effective rate closer to 15% because those lower brackets are like happy hour – everything’s cheaper.

FICA Taxes: Social Security and Medicare

Just when you thought we were done, along comes FICA – the tax everyone forgets about until they see their first paycheck. FICA is basically Social Security and Medicare’s joint cover charge, and most calculators include it because, well, you can’t avoid it.

Here’s what’s covered under the FICA umbrella:

● Social Security Tax: This one’s funding your future bingo nights and early bird specials. It pays for retirement benefits, disability insurance, and survivor benefits.

● Medicare Tax: Think of this as your contribution to future healthcare coverage. It funds Medicare, which provides health insurance primarily for folks 65 and up, plus some younger people with certain conditions.

The calculator estimates your FICA hit based on the current rates. Just remember, if you’re self-employed, you’re playing both parts in this dance – employee and employer – so your FICA bill might give you a bit more sticker shock.

State and Local Taxes: Considering Your Location

If you told the calculator where you live, it might throw in a state tax estimate for good measure. But here’s the deal – state taxes are like local weather: what works in Maine might make no sense in Miami.

Some states are like that friend who never asks for gas money (we’re looking at you, Texas and Florida – no state income tax), while others might take a bigger bite than you’d expect. The calculator usually keeps it simple with state taxes, using basic rates and rules. For the real nitty-gritty on your state tax situation, you’ll want to check your state’s tax department website or bug your local tax pro.

Factors Affecting Tax Calculator Accuracy: Limitations to Consider

Look, tax calculators are like those “estimated time of arrival” apps – helpful? Absolutely. Perfect? Let’s not get crazy. Before you tattoo those numbers on your forearm, let’s talk about what might make your actual tax bill look a bit different from what the calculator is telling you.

Deduction Complexity: Standard vs. Itemized

Here’s where most basic calculators start showing their limitations – they’re kind of like that friend who only knows the tourist spots in town. Sure, they’ll get you to the standard deduction, but what if you’ve got some spicier tax situations cooking?

Basic calculators often default to the standard deduction because, let’s face it, that’s what most folks use. But if you’re sitting on a pile of deductions that would make an accountant blush, you might want to dig deeper. We’re talking about:

● Medical expenses that made your wallet need its own doctor (those exceeding a certain percentage of your AGI)

● Home mortgage interest that feels like you’re buying your house twice

● State and local taxes (but don’t get too excited – there’s a $10,000 cap on these)

● Charitable contributions (because you’re fancy like that)

Here’s the thing – if your itemized deductions are doing the cha-cha well above your standard deduction threshold, a basic calculator might be overestimating your tax bill. It’s like trying to measure a race car’s speed with a bicycle speedometer – you’re missing some nuance there.

Tax Credits: Beyond the Basic Calculation

Now we’re getting into the really good stuff – tax credits. Basic calculators often treat these like that weird uncle nobody talks about at family gatherings. But credits? They’re the VIP passes of the tax world, doing a dollar-for-dollar reduction on your tax bill instead of just reducing your taxable income.

Here’s what might be lurking in the credit shadows:

● Child Tax Credit: Got kids under 17? Uncle Sam’s got a present for you.

● Earned Income Tax Credit (EITC): The government’s way of saying “thanks for working” to folks in the low-to-moderate income brackets.

● Education Credits: Because someone at the IRS remembers how expensive college was. Looking at you, American Opportunity Tax Credit and Lifetime Learning Credit.

● Child and Dependent Care Credit: For when you’re paying someone to watch the kids so you can go make the money to pay someone to watch the kids.

Here’s where it gets tricky – qualifying for these credits is like trying to solve a Rubik’s cube. Income limits, filing status, specific situations – basic calculators usually don’t have the bandwidth to process all these variables. So if you’re eligible for credits, your actual tax bill might end up looking better than what the calculator predicted.

Changes in Tax Law: Staying Updated

Remember how your phone keeps asking you to update its software? Tax laws are kind of like that, except instead of emoji updates, you’re getting new brackets, deduction amounts, and credit rules. Most calculators try to keep up, but sometimes they’re running on last year’s operating system, if you catch my drift.

Pro tip: Always check what tax year the calculator is calibrated for. Using a 2023 calculator for your 2024 taxes is like using last year’s GPS maps – you might get there, but you could miss some new shortcuts (or hit some new roadblocks).

Maximizing the Value of Your US Tax Calculator: Tips for Effective Use

Let’s talk about getting the most bang for your zero bucks from these tax calculators. Because let’s face it – free tools are great, but only if you know how to use them properly.

Gather Your Financial Information

Before you start punching numbers into that calculator like you’re playing Whack-a-Mole at the county fair, take a breath and gather your docs. Here’s your prep checklist:

● Annual income from everywhere money flows into your life – salary, side hustles, that crypto windfall you’re still not sure how to explain to your spouse

● Your filing status (and yes, “it’s complicated” isn’t one of the IRS’s options)

● A rough idea of your deductions if you’re thinking about itemizing

● Any tax credits you might qualify for (even if the basic calculator won’t ask for them – knowledge is power, folks)

Having this info ready is like showing up to a potluck with all your ingredients measured out – it just makes everything go smoother.

Explore Different Scenarios: “What-If” Analysis

Here’s where these calculators really earn their keep – playing out your “what-if” scenarios without having to bug your accountant every time. It’s like a flight simulator for your finances. You can:

● See what happens if you get that raise you’ve been eyeing (or if your side gig takes off)

● Compare tax implications of different filing statuses – maybe marriage isn’t just about love after all

● Calculate how much you’d save by bumping up your retirement contributions (future you says “thanks”)

● Run the numbers on itemizing versus taking the standard deduction (sometimes boring is beautiful)

This scenario planning isn’t just number-crunching – it’s more like financial chess, helping you think a few moves ahead.

Use Calculators as a Starting Point, Not Final Authority

Here’s the straight talk: your tax calculator is like WebMD for your finances – helpful for getting a general idea, but you probably don’t want to perform surgery based on it. It’s a starting point, not your tax gospel.

For the real deal, you’ll want to:

● Hit up the IRS website for the official rulebook (exciting reading, we know)

● Use legitimate tax software when it’s actually time to file

● Consider talking to a tax pro (CPA or Enrolled Agent) if your financial situation has more plot twists than a soap opera

Tax Calculators: The Bottom Line

Here’s the straight scoop on tax calculators – they’re like having a seasoned tax pro in your pocket, minus the hourly rate and coffee addiction. They’ll give you a solid heads-up on what’s coming tax-wise, help you play out those “what-if” scenarios (like whether that side gig is worth the hustle), and maybe save you from some nasty surprises come April.

But let’s be real – they’re not crystal balls. They’re more like sophisticated guessing machines that work best when you:

- Feed them accurate numbers (garbage in, garbage out, as we say in the business)

- Use them for planning rather than promises

- Remember they’re missing some of the finer points of tax law (like those sweet, sweet credits that could change everything)

Think of your tax calculator as your financial reconnaissance tool – great for scoping out the terrain ahead, but you’ll still want a pro navigator when it’s time to file. Use it to stay informed, run scenarios, and get a general sense of your tax picture. Just don’t bet the farm on those exact numbers, and definitely keep your accountant’s number on speed dial if your finances look more like a Picasso than a paint-by-numbers.

FAQ

To calculate tax in the US, multiply the taxable amount by the applicable tax rate. The tax rate varies by state and locality. Add the calculated tax to the original amount to get the total cost.

The US sales tax formula is: Sales Tax = Purchase Price × Tax Rate. The tax rate differs by state and locality. To find the total cost, add the calculated sales tax to the purchase price.

The formula for calculating taxable income is: Gross Income – Deductions = Taxable Income. Gross income includes all earnings, while deductions are allowable expenses or credits that reduce taxable income.

To calculate US tax on items, multiply the item’s price by the local tax rate. Add the resulting tax amount to the item’s price for the total cost. Tax rates vary by location and item type.