CAPM Calculator: Capital Asset Pricing Model Formula

The Capital Asset Pricing Model (CAPM) calculates an asset’s expected return based on its risk. The formula is E(R)=Rf+β(Rm-Rf), where E(R) is the expected return, Rf is the risk-free rate, β is the asset’s beta (risk level), and Rm is the market return. CAPM helps investors assess risk-adjusted returns and make investment decisions.

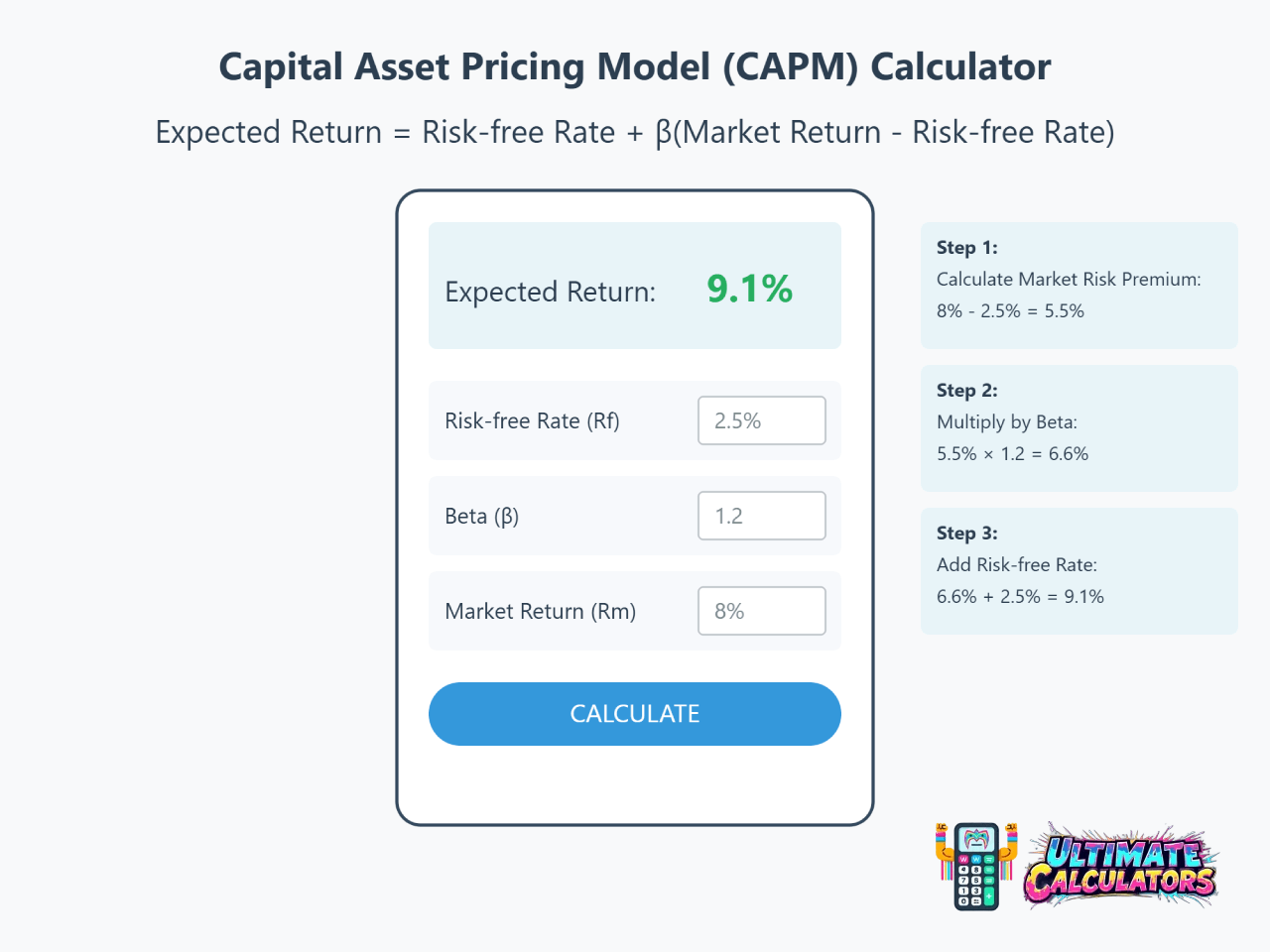

Capital Asset Pricing Model (CAPM) Calculator

Expected Return:

Formula: E(Ri) = Rf + [E(Rm) – Rf] * β

Where:

- E(Ri) = Expected Return on Investment

- Rf = Risk-Free Rate

- E(Rm) = Expected Market Return

- β = Beta

CAPM Calculator: Your Investment Risk Decoder

Grab these 3 numbers and let’s roll:

Risk-Free Rate: Snag today’s 10-year Treasury yield (hint: usually 3-5%)

Market Return: Pick your flavor:

- Quick: Use 10% (long-term S&P 500 average)

- Pro: Check recent analyst forecasts

Beta: Your investment’s drama level

- 0.5: Steady Eddie

- 1.0: Market twin

- 2.0: Wild child

Hit calculate. Green means go, red means whoa!

Below 10%: Playing it safer than a bank vault. Perfect for your “don’t touch” money.

10-20%: The sweet spot. Most long-term investors live here.

20-30%: Now we’re cooking! Hope you enjoy roller coasters.

Above 30%: Warning: Only for portfolios wearing a helmet.

Remember: Higher returns = Higher white knuckle factor.

Kick the tires with these pro moves:

- Compare Industries: Tech: Try beta 1.5+ Utilities: Start at beta 0.5 Banks: Around beta 1.0

- Test Market Moods: Bull: Push market return to 12% Bear: Drop it to 5% Reality: Usually between 8-10%

- Pro tip: Always sanity-check against current market conditions.

Getting strange results? Quick fixes:

- Negative return? Check your market return isn’t below risk-free rate.

- Sky-high return? Beta might be too spicy. Most stay under 2.0.

- Zero return? Numbers need love. All fields must be filled.

Remember: CAPM is a compass, not a GPS. Use it for direction, not exact coordinates.

Want a reality check? Compare with current market averages.

Calculator updated by Rhett C on February 2, 2025

Calculator updated on February 2, 2025

Add this calculator to your website

What is the Capital Asset Pricing Model (CAPM)?

Think of CAPM as the financial world’s way of answering a seemingly simple question: “What return should I expect for taking on this level of risk?”

It’s a cornerstone of modern finance theory that helps you calculate the expected rate of return for an investment or asset. The beauty of CAPM lies in its direct link between risk and return – it shows you exactly how much return you should expect for taking on a certain level of risk.

CAPM Formula Explained: Breaking Down the Calculation

At its heart, CAPM is built around a formula that might look like it escaped from a math textbook, but don’t worry – it’s actually quite straightforward once we break it down:

E(Rᵢ) = Rf + [ E(Rm) − Rf ] × βᵢ

Let’s decode each piece of this puzzle:

- E(Rᵢ) – Expected Return on Investment: This is your end goal – the return you might expect from a specific investment (i), expressed as a percentage. Think of it as your potential reward for taking on the investment’s risk.

- Rf – Risk-Free Rate: This is your baseline return – what you could earn with virtually no risk. Usually, this is based on government bonds like U.S. Treasury Bills. Consider it your “why bother?” rate – the minimum return you should accept before even considering a riskier investment.

- E(Rm) – Expected Market Return: This represents what you expect the overall market (like the S&P 500) to return. You can base this on historical data or future projections, but remember – past performance doesn’t guarantee future results.

- βᵢ – Beta: This is your risk meter. It measures how much your investment tends to move in relation to the market. A beta of 1 means it moves in lockstep with the market, while higher or lower betas indicate more or less volatility.

The formula essentially calculates your expected return by taking the risk-free rate and adding a risk premium that’s adjusted for your investment’s specific level of risk. Simple, right?

Why is CAPM Important for Investors?

Ever wondered why some investors seem to have a sixth sense for good investments? Spoiler alert: it’s not magic – it’s math. CAPM is like having a financial metal detector, helping you uncover hidden treasures (and avoid fool’s gold) in the investment landscape. Here’s why it’s such a valuable tool in your investment toolkit:

Risk-Adjusted Return

Think of this as your investment reality check. Anyone can tell you about potential returns, but CAPM helps you understand if you’re being adequately compensated for the risks you’re taking. It’s like having a friend who always asks the tough questions: “Sure, the returns look great, but have you considered the risk?”

CAPM helps you compare investments with different risk profiles on an even playing field. It’s the difference between comparing apples to oranges and converting everything to an apple-based economy. Finally, a way to make fair comparisons!

Investment Valuation

Here’s where CAPM really shines – it helps you spot whether an investment is priced right. By comparing the CAPM-calculated expected return to what the market’s actually offering, you can identify potential bargains or overpriced assets.

Think of it as your investment BS detector. If an asset’s actual expected return is higher than what CAPM suggests it should be, you might have found an undervalued gem. (Just remember, if something seems too good to be true, double-check your math!)

Portfolio Construction

CAPM isn’t just about individual investments – it’s a crucial tool for building diversified portfolios. It helps you understand how different assets work together, letting you construct portfolios that aim to:

- Maximize return for your chosen level of risk

- Minimize risk for your desired level of return

It’s like being the conductor of an investment orchestra, helping you ensure all your instruments are playing in harmony.

Decision Making

At its core, CAPM provides a framework for making smarter investment decisions. No, it won’t guarantee returns (nothing can do that unless you’ve got a time machine handy). But it does give you a more reasoned, risk-aware basis for choosing investments.

Think of CAPM as your investment GPS. While it can’t predict traffic jams (market crashes) or road construction (economic downturns), it can help you plot the most efficient route to your financial destination.

Just remember: like any tool, CAPM is most effective when used as part of a broader investment strategy. It’s not the only tool you need, but it’s definitely one you want in your toolbox.

How to Use the CAPM Calculator: A Step-by-Step Guide

Ready to take CAPM for a spin? Our calculator is like a financial GPS – just punch in a few numbers, and it’ll help you navigate the risk-return landscape. No financial degree required (though if you have one, feel free to nod knowingly at the math).

Input 1: Risk-Free Rate (Rf)

Ah, the risk-free rate – the “I could just leave my money here and nap” option. Here’s how to find it:

- Track Down the Current Rate: Head over to the U.S. Department of Treasury website or your favorite financial news site. Look for the 10-year Treasury yield – it’s like the vanilla ice cream of investments, basic but reliable.

- Enter it as a Percentage: If the Treasury yield is 4.5%, just type in 4.5. Easy peasy! (Pro tip: This rate changes more often than your neighbor’s Netflix password, so use current values for best results.)

Input 2: Expected Market Return (E(Rm))

Now for the crystal ball part – what do you think the market will do? Don’t worry, we’ve got some approaches to make this less like guessing tomorrow’s weather:

- Choose Your Method:

- Historical Average: Look at how the market (like the S&P 500) has performed over the last 50-100 years. Spoiler alert: it’s usually between 8-10% annually. Past performance doesn’t guarantee future results, but it’s better than asking your cat for investment advice.

- Analyst Forecasts: Check what the pros are predicting. They’re like weather forecasters, but with more expensive suits.

- Your Own Crystal Ball: Based on your research and economic outlook, what return do you expect? Sometimes your educated guess is as good as anyone’s.

- Enter Your Number: Type in your expected return as a percentage. If you think the market will return 9%, enter 9. (No need to show your work – we trust you!)

Input 3: Beta (β)

Beta is your investment’s mood ring – it shows how dramatically it reacts to market movements.

- Find Your Beta:

- Check financial websites like Yahoo Finance, Google Finance, or Bloomberg

- Look for the “Beta” value in the stock’s statistics section

- Coming soon: Our calculator will fetch this automatically! (Because manually looking up numbers is so 2023)

- Enter the Value: If your stock has a beta of 1.2, type in 1.2. Remember:

- Beta = 1: Your investment is a market copycat

- Beta > 1: Your investment is a drama queen (more volatile than the market)

- Beta < 1: Your investment is more chill than a cucumber

- Negative Beta: Your investment is a rebel (moves opposite to the market)

Click Calculate and… Voilà!

Hit that calculate button and watch the magic happen. You’ll see:

- Expected Return: Your calculated return, precise to two decimal places (because three would be showing off)

- Risk Level: A plain-English assessment of your risk (from “Smooth Sailing” to “Hold Onto Your Hat”)

Below the results, you’ll see the CAPM formula, just in case you want to impress someone at your next dinner party.

Remember: CAPM is like a kitchen scale – it’s precise but won’t tell you if your soufflé will taste good. Use it as one tool in your investment toolbox, not the whole shed.

Interpreting Your CAPM Results: Risk Levels and Expected Returns

So you’ve punched in your numbers and the calculator spat out some results. But what do these numbers actually mean for your investment journey? Let’s decode them like we’re breaking into a financial Da Vinci Code.

flowchart TD

M[Market Return: 10%] --> B1[Low Risk β=0.5]

M --> B2[Market Risk β=1.0]

M --> B3[High Risk β=2.0]

B1 --> R1[Expected Return: 7%]

B2 --> R2[Expected Return: 10%]

B3 --> R3[Expected Return: 16%]

style M fill:#e5f2ff,stroke:#2563eb,stroke-width:2px

style B1 fill:#f0fff4,stroke:#38a169,stroke-width:2px

style B2 fill:#fff5f5,stroke:#e53e3e,stroke-width:2px

style B3 fill:#faf5ff,stroke:#805ad5,stroke-width:2px

note[Based on Risk-Free Rate = 4%]

style note fill:#f8f8f8,stroke:#666,stroke-width:1pxUnderstanding the Expected Return Percentage

Think of the Expected Return percentage as your investment’s “weather forecast.” It’s CAPM’s educated guess about what return you should expect given the risk you’re taking. Like any forecast, it’s more “probable” than “promise” – the financial equivalent of packing both sunscreen and an umbrella.

Your Expected Return serves three main purposes:

- Investment Comparison: It’s your financial matchmaker. When two investments have similar risk profiles (betas), the one with higher Expected Return might be the better catch. (Though remember, looks can be deceiving!)

- Performance Benchmarking: Think of it as your investment’s report card. If your actual returns consistently get lower grades than CAPM predicted, it might be time for some tutoring (or a portfolio adjustment).

- Reality Check: Remember, this is an expectation, not a guarantee. Markets are like cats – they rarely do exactly what you expect them to do.

Risk Levels: Low, Moderate, High, Extreme – What Do They Mean?

Let’s break down these risk levels like spice ratings at a Thai restaurant:

| Risk Level | Expected Return Range | What It Really Means |

|---|---|---|

| Low Risk | Below 10% | The investment equivalent of vanilla ice cream. Stable but modest returns. Perfect for those who get nervous watching their portfolio value change. |

| Moderate Risk | 10% – 20% | The “golden retriever” of investments – generally well-behaved but might occasionally chase a squirrel. Balances growth potential with reasonable volatility. |

| High Risk | 20% – 30% | Like ordering the extra-spicy option – higher potential satisfaction, but keep the water handy. For investors comfortable with significant volatility seeking aggressive growth. |

| Extreme Risk | Above 30% | The financial equivalent of skydiving. Spectacular views possible, but pack a parachute. Only for investors with iron stomachs and very high risk tolerance. |

Interactive Sensitivity Analysis: Playing “What If” With Your Future

Coming soon to a calculator near you: our interactive sensitivity analysis feature! Think of it as your investment simulator where you can:

- Play Scenario Planner: What if the market return is higher than expected? What if your investment’s beta changes? It’s like having a financial crystal ball (but with actual math behind it).

- Spot the Puppet Masters: See which inputs pull the biggest strings in your expected return. Sometimes tiny changes can have surprisingly big impacts.

- Get the Big Picture: Understand how all these moving parts dance together to create your final expected return. It’s like watching a financial ballet, but with fewer tutus and more spreadsheets.

Remember: CAPM is like GPS for your investment journey. It won’t prevent all wrong turns, but it sure beats navigating by gut feeling alone!

Beyond the Calculation: Limitations and Assumptions of CAPM

Let’s have a heart-to-heart about CAPM’s quirks and features (as they say in the car review world). Like your friend who claims they’re a great cook but only makes pasta, CAPM is amazing at what it does – but it’s not perfect for every situation.

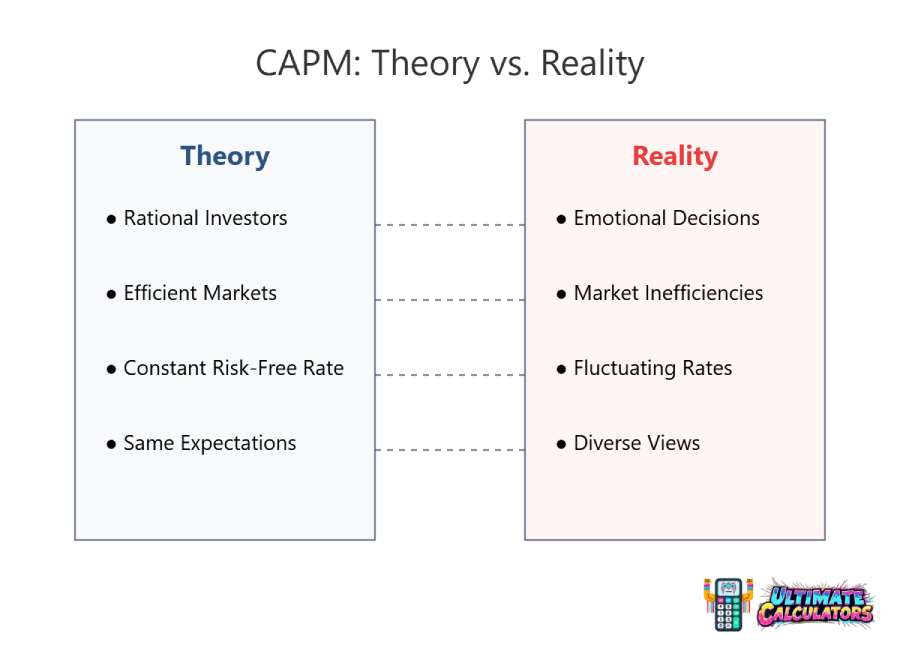

Key Assumptions of the CAPM Model

Remember when you played sports video games and the computer players always made perfect decisions? That’s kind of what CAPM assumes about investors. Let’s peek behind the curtain at these idealistic assumptions:

- Rational Investors: CAPM thinks all investors are like Spock from Star Trek – purely logical beings who never make emotional decisions. (Spoiler alert: We’re all more like Captain Kirk sometimes.)

- Efficient Markets: The model assumes markets are as organized as a librarian’s desk – every piece of information is filed away perfectly in asset prices. Meanwhile, real markets can sometimes look more like a teenager’s bedroom.

- Homogeneous Expectations: According to CAPM, all investors see the future the same way. It’s like assuming everyone agrees on the best pizza toppings – charming thought, but not exactly realistic.

- Risk-Free Rate Exists and is Constant: The model expects a truly risk-free investment that never changes. Sort of like assuming there’s a completely safe place to keep your chocolate that your roommate will never find.

- No Transaction Costs or Taxes: CAPM lives in a world where trading is free and the tax man doesn’t exist. (If only!)

- Investors are Price Takers: The model assumes individual investors can’t influence prices, like assuming your shopping habits don’t affect Amazon’s stock price. (Unless you’re Warren Buffett, this one’s actually pretty accurate!)

Real-World Limitations to Consider

Now, let’s talk about what happens when CAPM meets reality, like a theoretical physicist trying to cook dinner:

- Beta Instability: Beta is supposed to be as stable as your grandma’s secret recipe, but in reality, it changes more often than fashion trends. A company’s risk profile can shift dramatically as its business evolves.

- Market Return is Unpredictable: Trying to estimate market returns is like trying to predict the weather – even the experts get it wrong. Economic shocks, geopolitical events, and that weird thing that happened on Twitter can all throw predictions off course.

- Single-Factor Model: CAPM is like trying to judge a book by its cover price – it only looks at one factor (systematic risk) when real investments are more complex. It’s missing things like company size, value vs. growth characteristics, and whether the CEO has a good track record of returning shareholder calls.

When is CAPM Most and Least Useful?

Most Useful When:

- Analyzing broad market trends (think bird’s-eye view)

- Comparing companies in the same industry (apples to apples)

- Planning long-term investments (the tortoise approach)

- Starting your analysis (it’s like the first coffee of the day – gets you going but shouldn’t be your only source of energy)

Least Useful When:

- Day trading (it’s not built for speed)

- Analyzing private companies (can’t calculate beta without public market data)

- During market chaos (like using a compass in a magnetic storm)

- Making it your only tool (like trying to build a house with just a hammer)

Remember: CAPM is like a map of the investment world – incredibly useful for general navigation, but it won’t tell you about traffic jams or road construction. Use it as part of your toolbox, not as your only tool.

And hey, even with these limitations, CAPM is still one of the most useful models in finance. It’s like democracy – not perfect, but better than most alternatives!

CAPM in Excel: Formula and Practical Application

Ever wished you could do CAPM calculations as easily as adding up your coffee expenses? Well, grab your favorite spreadsheet snack, because we’re about to turn Excel into your personal CAPM calculator. No fancy software required – just you, Excel, and maybe a caffeinated beverage of your choice.

The CAPM Formula for Excel: Step-by-Step

Let’s transform that intimidating financial formula into something Excel can understand. Think of it as teaching your spreadsheet to speak “finance.”

Step 1: Set Up Your Spreadsheet Stage

First, let’s give our data a proper home. Label these cells (because future-you will thank us for the organization):

- Cell A1: “Risk-Free Rate (Rf)”

- Cell A2: “Expected Market Return (Rm)”

- Cell A3: “Beta (β)”

- Cell A4: “Expected Return E(Ri)”

Pro tip: Think of these labels as your spreadsheet’s name tags at a financial networking event.

Step 2: Enter Your Input Values

In the cells next to your labels (B1, B2, B3), enter your numbers:

- Risk-Free Rate:

0.045(if it’s 4.5%) - Expected Market Return:

0.09(if it’s 9%) - Beta:

1.2(if that’s your beta)

Remember: Enter these as decimals, not percentages – Excel gets cranky about the difference!

Step 3: The Magic Formula

In cell B4 (next to “Expected Return”), enter our star of the show:

=B1 + (B2 - B1) * B3This is like telling Excel: “Take the risk-free rate, add it to the market risk premium (market return minus risk-free rate) multiplied by beta.” Excel nods sagely and does the math for you.

Step 4: Make It Pretty

Right-click on your result cell, select “Format Cells,” and choose “Percentage” with two decimal places. Because nothing says “I know what I’m doing” like properly formatted numbers.

Pro Tips for Excel CAPM Mastery

- Save Time with Named Ranges: Instead of remembering cell references like they’re your ex’s phone number, name your input cells:

- Risk_Free_Rate for B1

- Market_Return for B2

- Beta for B3 Now your formula can read like poetry:

=Risk_Free_Rate + (Market_Return - Risk_Free_Rate) * Beta- Add Data Validation: Keep your inputs in check by adding validation rules:

- Beta usually falls between -2 and 4

- Risk-free rate is typically between 0% and 10%

- Market return historically ranges from -30% to 30% It’s like having a financial bouncer keeping the crazy numbers out.

The Pre-Built Template: Your Express Lane to CAPM Calculations

Why reinvent the wheel when you can ride in style? We’ve created a ready-to-use CAPM calculator template in Google Sheets. It’s like getting the answers to the test, but totally legal.

You can access it here.

Just make a copy, and you’re ready to start calculating expected returns faster than you can say “systematic risk premium.”

Remember: This template is like a good recipe – feel free to modify it to suit your taste. Add your own bells and whistles, create multiple scenarios, or link it to other financial models. The spreadsheet world is your oyster!

Note: We built this template while fully caffeinated and double-checked all formulas. But as with any financial tool, always verify the results match your expectations. Trust, but validate – it’s the spreadsheet user’s motto!

CAPM vs. Other Investment Valuation Methods

Welcome to the investment world’s version of “Choose Your Fighter!” In this corner, wearing the blue shorts and sporting a fancy Greek letter (β), we have CAPM. And in the other corners… well, let’s meet our contestants.

graph LR

subgraph CAPM[Capital Asset Pricing Model]

C1[Input: Beta + Market Return]

C2[Complexity: Low]

C3[Best For: Expected Returns]

end

subgraph DDM[Dividend Discount Model]

D1[Input: Future Dividends]

D2[Complexity: Medium]

D3[Best For: Income Stocks]

end

subgraph DCF[Discounted Cash Flow]

F1[Input: All Cash Flows]

F2[Complexity: High]

F3[Best For: Company Value]

end

classDef default fill:#f9f9f9,stroke:#333,stroke-width:2px

classDef low fill:#e6ffec,stroke:#22863a

classDef medium fill:#fff8e6,stroke:#b08800

classDef high fill:#ffe6e6,stroke:#cb2431

class CAPM,C1,C2,C3 low

class DDM,D1,D2,D3 medium

class DCF,F1,F2,F3 highThink of these valuation methods as different tools in your financial Swiss Army knife. Sometimes you need the scissors (CAPM), sometimes you need the bottle opener (DDM), and sometimes you need the whole thing (DCF).

CAPM vs. Dividend Discount Model (DDM)

Imagine you’re choosing between two fortune tellers. One (CAPM) looks at your astrological risk profile, while the other (DDM) just counts the money falling from your pockets.

CAPM’s Approach

- Focuses on risk and return like a helicopter parent watching their kid on a jungle gym

- Calculates expected return based on that mysterious Greek letter β (beta)

- Perfect for figuring out what return you should demand for putting up with market drama

DDM’s Approach

- Counts future dividends like a squirrel counting nuts for winter

- Calculates actual dollar value based on expected future payouts

- Best for companies that treat dividends like clockwork (looking at you, utility companies)

Key Differences

- Input Focus: CAPM wants to know about the whole market; DDM just cares about your company’s dividend game

- Output Focus: CAPM tells you what return to expect; DDM tells you what price to pay

- Applicability: CAPM works on anything with a beta; DDM needs regular dividends like a cactus needs water (not much, but consistently)

CAPM vs. Discounted Cash Flow (DCF) Analysis

Now this is like comparing a speed dating session (CAPM) to a full background check (DCF).

CAPM’s Approach

- Quick and dirty risk-adjusted return calculator

- “Tell me your beta, and I’ll tell you your fortune”

- Perfect for when you need a quick answer at a cocktail party

DCF’s Approach

- Detailed analysis of every penny a company might generate

- Forecasts more numbers than a weather station

- Takes into account everything including the kitchen sink (and the company’s plans to upgrade it)

Key Differences

- Input Focus: CAPM looks at market risk factors; DCF wants to know what you had for breakfast (and every other detail about cash flow)

- Output Focus: CAPM gives you expected return; DCF gives you a proper price tag

- Complexity: CAPM is like making instant coffee; DCF is like running a full coffee shop

The Plot Twist

Here’s the fun part – these methods actually work together! The expected return from CAPM often becomes the discount rate in DCF analysis. It’s like CAPM is the opening act for DCF’s main show.

The Verdict

Look, choosing between these methods is like picking your favorite child (not that you’d ever admit to having one). Each has its moment to shine:

- Use CAPM when you need a quick, risk-adjusted return estimate and don’t have time to read through 500 pages of financial statements

- Use DDM when you’re looking at steady dividend payers and want to know if the price is right

- Use DCF when you’ve got time, coffee, and a desire to really understand what makes a company tick

The secret sauce? Use them together. It’s like cross-referencing your GPS with an actual map and your friend’s questionable sense of direction – more data points = better decisions.

Remember: These tools are like opinions – everyone’s got them, and they work best when you use several at once. Just don’t tell CAPM we said that. It can get a bit sensitive about its beta.

Conclusion: Empowering Your Investment Decisions with CAPM

The Capital Asset Pricing Model is like your financial metal detector – it won’t find every treasure, but it’ll help you avoid digging in all the wrong places. Think of it as adding night-vision goggles to your investment toolkit: suddenly, those risk-return relationships become a lot clearer in the dark.

No, CAPM won’t guarantee investment success (if anyone promises that, check if they’re trying to sell you oceanfront property in Arizona). But it will help you make more informed decisions by putting actual math behind that gut feeling about risk and return.

The beauty of CAPM lies in its practical simplicity: plug in three numbers, get one powerful insight. Whether you’re building a retirement portfolio or just trying to figure out if that hot stock tip from your uncle is worth the risk, CAPM gives you a rational framework for making those choices.

So fire up that calculator, grab your favorite beverage, and start exploring. Your investment decisions are about to get a whole lot smarter. And remember – in the world of investing, being approximately right is far better than being precisely wrong.

FAQ

Calculate the Capital Asset Pricing Model (CAPM) using the formula E(R) = Rf + β(Rm − Rf). Identify the risk-free rate (Rf), the asset’s beta (β), and the expected market return (Rm). Subtract Rf from Rm, multiply by β, then add Rf to get the expected return (E(R)).

The CAPM formula in Excel is =RF + (Beta * (RM – RF)), where RF is the risk-free rate, Beta is the stock beta, and RM is the expected market return. Use =COVARIANCE.P(range1, range2)/VAR.P(range1) to calculate Beta or pull data from financial sources.

The Capital Asset Pricing Model (CAPM) calculates the expected return of an asset based on its risk. The formula is E(R) = RF + Beta * (RM – RF), where RF is the risk-free rate, Beta measures market risk, and RM is the expected market return. CAPM helps investors assess risk and return.

The Capital Asset Pricing Model (CAPM) equation has four components: the expected return of an asset, the risk-free rate, the market risk premium, and beta. The formula is: Expected Return (ER) = Risk-Free Rate (Rf) + Beta (β) × (Market Return (Rm) – Risk-Free Rate (Rf))

Cloud Solutions Tailored to Company Needs

- Deliver innovative cloud solutions

- Effective ways to solve complex challenges

- Cloud solutions align with vision and goals

The Trusted Partner:

Why Businesses Trust CloudSprout

Use this paragraph section to get your website visitors to know you. Consider writing about you or your organization, the products or services you offer, or why you exist. Keep a consistent communication style.

Testimonials are a social proof, a powerful way to inspire trust.

100% Secure Payments

Your payments are safe with us

24/7 Support

Contact us at all times

100% Money Back Guarantee

30 Day Trial Period